2023 Legislative Update 4

2023 Legislative Update 4

Week 4

January 30 - February 4

Our work continues to be in standing committees as we hear bills for consideration to pass on to the full House. A major announcement was made this week when Governor Laura Kelly and the State Finance Council approved a follow-up megaproject to Panasonic.

I'm excited to report that HB 2028, which will provide for a streamlined, automated process for the sealing/expungement of criminal records from public view, passed the House Judiciary Committee unanimously.

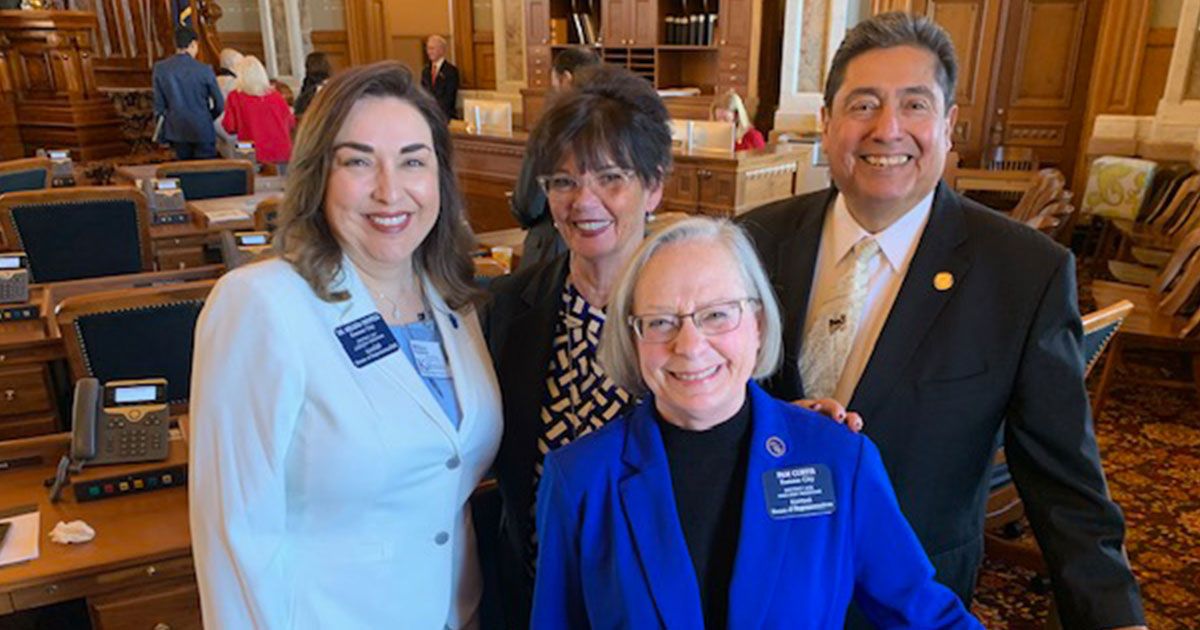

Many thanks to the Kansas City, Kansas Chamber of Commerce for hosting the Wyandotte County Legislative Delegation Luncheon! We appreciate members of the Chamber taking the time to visit with us in Topeka and discuss many of the issues under consideration.

Greg Kindle and Monica Brede with the Wyandotte County Economic Development Council were in Topeka for the Kansas Economic Development Association Day on the Hill. I enjoyed joining them for lunch and catching up on legislation that is moving through the process to get their input on how it will impact our community.

It is a special honor to serve as your state representative. I value and appreciate your input on issues facing state government. Please feel free to contact me with your comments and questions. My office address is Room 452-S, 300 SW 10th, Topeka, KS 66612. You can reach me at (785) 296-7430 or call the legislative hotline at 1-800-432-3924 to leave a message for me. You can also e-mail me at

pam.curtis@house.ks.gov

“Clean Slate” HB 2028: Automated process for expungement of records

The House Judiciary Committee unanimously approved HB 2028, the “Clean Slate” bill, which now advances to the full House for consideration. The bill is drafted based on the recommendations of the Kansas Judicial Council's Criminal Law Advisory Committee. It will provide for an automated process for sealing of criminal records from public view, referred to as expungement.

Other states have adopted various measures of Clean Slate legislation to help remove barriers for returning citizens. Clean Slate legislation will help thousands of Kansans who are eligible for expungement however lack the time and resources to get their record expunged manually.

Expungement removes a barrier to opportunity and gives people with criminal records a chance to move on with their lives and get back to work once they have paid their debt to society. There is growing support among the business community for Clean Slate legislation and as they adopt and participate in second chance hiring policies.

I want to thank the members of the Clean Slate Coalition that have been working on this legislation for the past 4 years. It is because of their effort and preservice that we have been able to gain support and momentum for this measure.

Prevailing Wage

Paying prevailing wage is something I have championed since I was elected to the legislature. This year members of the Wyandotte County Legislative Delegation will once again introduce a bill to restore local control for requiring prevailing wage be paid on public construction projects. I

Appreciate Andy Martin, Workforce Development Business Representative with IUOE Local 101 putting together a very nice informational piece on prevailing wage to help inform legislators on this issue.

First and foremost, prevailing wage is a local control issue. In 1891, Kansas was the first state to pass a “prevailing wage” for its own projects. In 2013, the Kansas Legislature

stripped local governments of their right to incorporate prevailing wage requirements into public projects. Advocates for prevailing wage claim reinstatement would restore local control and return discretion to communities.

Prevailing-wage laws do not have a major impact on government contracting costs. They do however support a highly skilled and safe construction workforce that delivers construction projects more cost efficiently and improves the overall economic health of communities.

Adopting prevailing wage requirements would be optional and at the discretion of local communities if they deem appropriate. This is not a mandate; it merely gives local government units the ability to decide what’s best for them.

Labor in the House

This week House Democrats heard from the Working Kansas Alliance,

“a coalition of union and non-union groups dedicated to protecting the rights of the hard-working Kansas

families that fuel our State’s economy at every turn.” The group collectively represents over 500,000 Kansans.

The caucus heard from SMART TD (Sheet Metal, Rail, and Transportation), KOSE (Kansas Association of State Employees), and the Tri-County AFL-CIO, one of nearly 500 state and local labor councils of the AFL-CIO.

The group laid out their legislative priorities:

- Prevailing Wage

- Economic Development

- Tax Relief for Working Families

- Support Public Education Funding

- Medicaid Expansion

- Public Employee Rights, Pay, & Benefits

- Fair Share

- Raising the minimum wage

- Workers’ rights and the freedom to unionize

- Workplace Safety

- Payday Loan Reform

- Worker’s Comp., the UI Nominating Committee & UI Benefits

- Medical Marijuana Legalization

The CHIPS Act Expands to Kansas: Integra Technologies

On Thursday, the State Finance Council approved an economic incentive agreement for

Integra Technologies. Integra plans to invest in a large-scale semiconductor manufacturing facility in Wichita. The plant is expected to create 5,000 high-paying jobs. In addition, Integra hopes to secure incentives through the federal CHIPS act, which aims to create a domestic supply chain of semiconductors.

“As the second-largest private investment in Kansas history, this project will be transformative for our state’s economy, providing over 5,000 high-paying jobs that will help more Kansans create better lives for themselves and their children,” Governor Laura Kelly said. “Integra’s investment is further proof that we have put Kansas on the map, establishing our state on the forefront of innovation and national security.”

Last year’s APEX incentive -- the largest private investment in Kansas history -- brought a

$4 billion battery manufacturing plant to DeSoto, Kansas. The batteries, for electric vehicle creation, are in high demand. The Panasonic plant promises 4,000 well-paying jobs and $2.5 billion in economic activity and is expected to be supported by the new semiconductor plant.

“The semiconductors we work on are in multiple space applications, such as the Mars Rover and Hubble Telescope; more than 100 Department of Defense programs of record; as well as commercial applications that power everyday life,” Integra Technologies President and CEO Brett Robinson said. “On behalf of our employee-owners, we are especially grateful for Governor Kelly, Lt. Governor Toland, and Kansas legislative leadership on the State Finance Council for supporting Integra with its premier economic development program, positioning us to transform domestic Outsourced Semiconductor Assembly and Test services while expanding in our home state.”

“A $1.8 billion semiconductor plant is planned for Wichita through another Kansas megaproject deal,”

KCUR, 2/2/2023

So-Called School Choice

The Republicans in the House have launched another round of attacks on public education.

In the K-12 Education Budget committee this week, legislation was put forward which will effectively function as a tax scam. Under the guise of “school choice,” the bill would strip public schools of their funding, one student at a time.

The legislation

expands tax credits given to parents who choose private schools over public schools. Rep. Jarrod Ousley said public schools are “the fabric of our nation.” Taxpayer money belongs in public schools.

Here is a link to an article about committee’s debate on School Choice:

“School-choice debate heats up in Kansas,” Washington Post, 1/31/2023

Adoption Bill

A bill was introduced to repeal the so-called “Kansas Adoption Protection Act,” which allows religious adoption agencies to discriminate against the LGBTQ+ community. The bill, which is certainly not about protecting adoption, was passed in 2018 after a late-night vote.

Back to Brownback Flat Tax

Immediately after releasing

HB 2061, the bill’s sponsors received a wave of backlash for the fiscal irresponsibility of the proposal. HB 2061, an aggressive, expensive “flat tax,” would cost Kansas more than $3 billion over the next three years.

House Democratic Leader Vic Miller released a statement saying, “This legislation will pull us right back into the Brownback dumpster fire, famous for making Kansas a late-night television punchline.

Under this bill, Kansans making $250,000 or more would get an average of $5,000 in tax cuts and Kansans making $25,000 or less would get an average of $143 back.”

Governor Laura Kelly, who has made headlines for rehabilitating the state’s coffers after Brownback nearly ran the state’s finances into the ground, said the proposal “would do more

damage more quickly than the Brownback tax

experiment of 2012 and 2013.”

Across the Rotunda: The Senate Democrats

Senator Pat Pettey has a hearing next week in Senate Education on her bill addressing the teacher shortage facing Kansas schools. Senate Bill 66 would enact the Interstate Mobility Compact to recognize equivalent teacher licenses across member states.

The Senate Committee on Federal and State Affairs is hearing this session’s iteration of the “Eddie the Eagle” bill on Wednesday, which would put the National Rifle Association’s curriculum in our classrooms. Governor Laura Kelly vetoed similar legislation in 2021. The Senate Tax Committee also has a hearing on Thursday on the Convention of States, which has the potential of allowing a group of unelected “delegates” to design a completely new form of government.

Senate Tax also has hearings on two bills addressing taxes for retirees. The first, SB 52, would increase the income limit for the exemption of Social Security benefits from state income taxes. The second, SB 33, would exempt ALL Social Security benefits from state income taxes.

From the House Floor

- HB 2015: Authorizing the designee of an employing agency or entity to petition the court for an order requiring infectious disease testing. Passed on Final Action, 116-6.

- HB 2016: Clarifying how property held under a transfer-on-death deed is distributed when one beneficiary predeceases the grantor. Passed on Final Action, 122-0.

- HB 2017: Enacting the uniform family law arbitration act. Passed on Final Action, 122-0.

- HB 2018: Permitting a will or a copy of a will filed within six months after the death of the testator to be admitted to probate at any time. Passed on Final Action, 120-2.

Did you know? All committee hearings and chamber proceedings can be found on the Kansas Legislature’s

YouTube page.

Resources

My Legislative Facebook Page

My Twitter Account

My Website

Kansas Legislature Website

Did you know?!

All committee hearings can be found on the Kansas Legislature’s YouTube page.

Resources